By Antonio Hendrickson

As a proud co-owner of Legends Restaurant, I see everyday how Harlem exists as a hub of culture, history, and resilience, and local businesses like mine are at the heart of that legacy.

But the reality is, many small businesses here—especially restaurants—are still struggling to recover from the challenges brought on by the pandemic. In Central Harlem, where nearly 30% of residents live below the Federal Poverty Level, the survival of our businesses isn’t just about economics; it’s about keeping our community alive.

That’s why Capital One’s $265 billion Community Benefits Plan (CBP), which will roll out if the merger with Discover is approved, is exciting. This plan is more than just big numbers—it’s a lifeline for businesses like mine and so many others in Harlem. With $15 billion specifically set aside for small business lending in low- and moderate-income (LMI) communities, the CBP is exactly the kind of investment our neighborhood needs. For many small business owners, access to affordable credit is the difference between keeping the doors open or shutting down. This plan could help so many entrepreneurs in Harlem not only stay afloat but also grow, hire more local residents, and contribute to the vibrancy of our streets.

Another aspect of the CBP that resonates with me is the $5 billion commitment to spending with diverse suppliers. Harlem is home to an incredibly diverse mix of businesses, many of them owned by women, minorities, and other underrepresented groups. Ensuring that these businesses have access to larger contracts and opportunities is key to leveling the playing field and fostering inclusive economic growth in our community.

One of the things I appreciate most about Capital One’s approach is their collaboration with organizations that know our communities inside and out, like the National Association for Latino Community Asset Builders (NALCAB), NeighborWorks America, the Opportunity Finance Network (OFN), and the Woodstock Institute. By working with partners that have deep roots in diverse communities, Capital One is making sure that the support reaches those who need it most. In Harlem, that kind of targeted, thoughtful investment could be transformative.

- The Ultimate Guide To Customizing Your Cubicle Partition For Comfort And Style

- Eco-Friendly Cubicle Partitions: Sustainable Office Design Ideas

- Sponsored Love: Luther Never Too Much In Harlem And At The Beacon NY

- FDA’s Concerns With Unapproved GLP-1 Drugs Used For Weight Loss From Harlem To Hawaii

- Two-Thousand Turkeys To Be Distributed By Anti-Poverty Nonprofit Oyate Group From Harlem To Hollis

For small businesses in neighborhoods like ours, the pandemic wasn’t just a setback; it was a reckoning. Many of us had to reinvent how we operate, but even with all that effort, we’re still facing barriers like rising costs, supply chain disruptions, and difficulties in accessing capital. The CBP’s focus on expanding financial inclusion—especially for small businesses—is critical. It’s not just about surviving the next crisis; it’s about building something sustainable that benefits the whole community.

Capital One’s CBP is more than just another corporate plan. It’s a commitment to investing in small businesses, preserving the cultural fabric of neighborhoods like Harlem, and creating opportunities for those who’ve been historically left out. As a business owner who is deeply rooted in this community, I strongly encourage and support the Capital One-Discover merger. It’s an opportunity to bring vital resources to small businesses in Harlem and beyond, allowing us to keep our doors open, continue serving our neighbors, and contribute to the rich, diverse legacy of this incredible community.

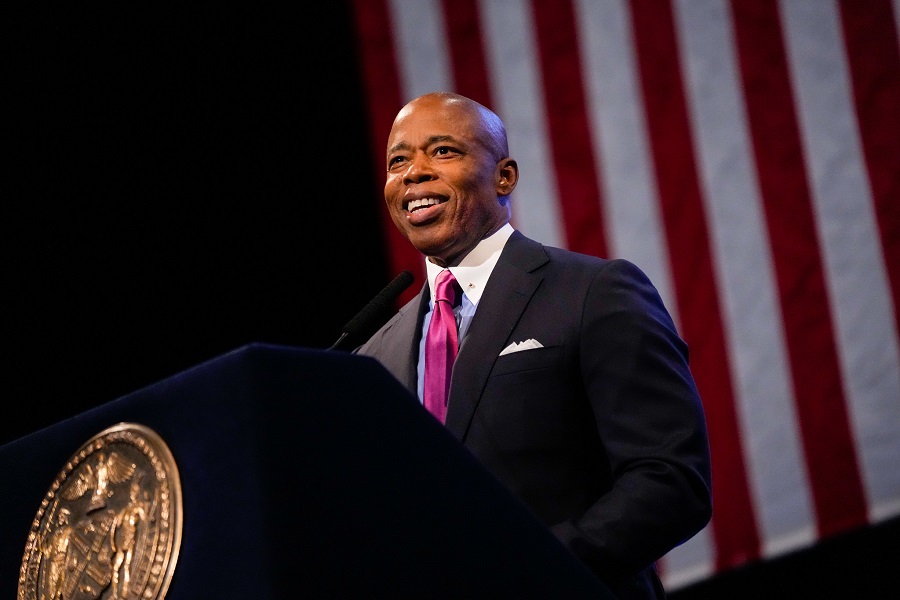

Antonio Hendrickson

Co-owner, of Legends Restaurant, and owner of at-risk youth nonprofit organization, a mentoring program in which older convicts counseled younger inmates about behavior patterns leading to incarceration through Harlem and the South Bronx, NY.

Photo credit: Antonio Hendrickson.

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact