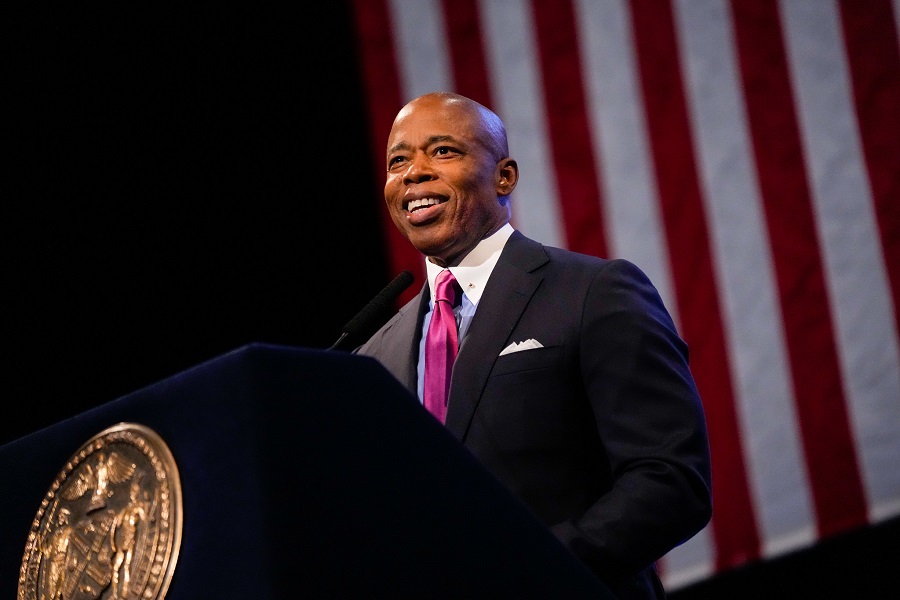

New York City Mayor Eric Adams and New York City Department of Consumer and Worker Protection (DCWP) Commissioner Vilda Vera Mayuga today released data today.

The new data highlighting the success of the enhanced “NYC Earned Income Tax Credit” (EITC), which was expanded for the first time in nearly 20 years in 2022 after Mayor Adams convinced the state Legislature to bolster the social safety net and expand services for working-class families in New York City. In tax season 2023, over 746,000 New Yorkers received more money thanks to the enhancement, putting $345 million back into the pockets of New Yorkers living in some of the lowest income communities in the city, an additional $280 million from the previous tax season. Mayor Adams marked the occasion by cutting the ribbon on the second Urban Upbound Federal Credit Union branch, further supporting the rich and expanded ecosystem of the city’s free Financial Empowerment Center and NYC Free Tax Prep services overseen by DCWP.

“In New York City, working people should get a fair shot and their fair share. That is why we are building a city that works for all New Yorkers,” said Mayor Adams. “Two years ago, we successfully advocated for Albany to expand the Earned Income Tax Credit for this first-time in 20 years, and because of our efforts, last year, we put $345 million back into the pockets of working-class New Yorkers — a 432 percent increase from the tax season before that. Over 746,000 New Yorkers received the benefit, and we will continue to fight to make New York City more affordable so all families can continue to prosper in the greatest city in the world. We are also proud to offer a range of services and supports through our financial empowerment programs, including by partnering with organizations like Urban Upbound. Congratulations to them on the opening of their new space.”

“One of this administration’s key priorities is putting more money in New Yorkers’ pockets, and our enhanced New York City Earned Income Tax Credit has delivered that in spades, benefiting nearly 750,000 New Yorkers,” said Deputy Mayor for Housing, Economic Development, and Workforce Maria Torres-Springer. “We will continue to take advantage of every tool we have to make it easier for working class families to thrive in the city, from the enhanced EITC to the range of other free tax prep and financial empowerment programs that DCWP delivers with community partners like Urban Upbound.”

“Since the beginning of this administration we have been committed to delivering for working-class New Yorkers and doing all we can to make New York City a place where they can thrive,” said DCWP Commissioner Mayuga. “I am proud of the work our NYC Free Tax Prep program has done to put more money back into the pockets of New Yorkers, from saving our neighbors nearly $24 million in filing fees in tax seasons 2022 and 2023 to helping filers get millions of dollars in vital tax credits, like the enhanced NYC EITC. Thank you to Mayor Adams for prioritizing the needs of some of our communities with lowest incomes.”

“I am thrilled to stand with Mayor Adams and our partners to introduce this transformative banking resource to the Astoria community,” said Bishop Mitchell G. Taylor, CEO and co-founder, Urban Upbound. “The Urban Upbound Federal Credit Union stands as a beacon of economic empowerment and self-reliance, serving as a vital cornerstone alongside tax prep and the Earned Income Tax Credit to uplift and strengthen our community.”

NYC EITC contributed $345 million in benefits for New Yorkers across tax season 2023, representing a 432 percent increase from tax season 2022

The average amount of money received by a filer who qualifies for the NYC EITC increased from $107 in tax season 2022 to $462 in tax season 2023 — an increase of $355 or 332 percent. The overall amount of money received due to the enhanced NYC EITC increased by 432 percent — from $64.8 million in tax season 2022 to $345 million in tax season 2023. Tax seasons 2022 and 2023 covered tax years 2021 and 2022, respectively.

- Harlem’s Claremont Inn, Home Of Presidents, Dukes, Princes, A Princess’s And Others, 1804

- Southampton: Year-Round Charm, Business Leaders Unite To Energize Southampton’s Economy

- What’s Up Miss Lil: Harlem Cultural Festival Foundation Celebrates 55 Years Of Soul

- What’s Up Miss Lil: 2024 NYC Marathon Journey Through Harlem

- Mayor Adams Announces City Hall And Buildings To Shine Green For Youth

Since the start of the Adams administration through December 2023, DCWP’s NYC Free Tax Prep program helped New Yorkers file more than 156,000 tax returns for free, saving them nearly $24 million in tax preparation fees. And this past tax season, more than 140 in-person sites provided free tax preparation services across the five boroughs. NYC Free Tax Prep providers also offered drop-off services and virtual tax preparation services. Last fall, DCWP also launched NYC Free Tax Prep for self-employed filers, offering specialized services tailored to gig workers, freelancers, and small business owners who often face barriers to filing taxes and managing financial recordkeeping.

Mayor Adams today marked these achievements by joining Urban Upbound at the grand opening of its second federal credit union branch located in Astoria, Queens. The credit union offers affordable financial services, including access to capital, asset-building vehicles, and ownership stakes to its members. These services complement Urban Upbound’s existing Financial Empowerment Center and NYC Free Tax Prep services, overseen by DCWP, including through free financial counseling to help New Yorkers improve their financial health with one-on-one support on banking, credit, debt, and savings topics, as well as free tax preparation services to help New Yorkers — including self-employed filers and small business owners — claim valuable tax credits and avoid costly tax prep fees.

Thanks to the Adams administration’s successful advocacy in Albany, the Fiscal Year 2023 adopted state budget increased the state and city match to the federal EITC for the first time in nearly 20 years. After the city committed $250 million annually to the NYC EITC, it received a one-time state payment of $100 million. The NYC EITC increased from a 5 percent match of the federal EITC levels to 10 to 30 percent depending on the filers’ income. Under the city’s expansion of this tax credit in tax season 2023, a single parent with one child and an annual income of $14,750 or less saw their benefit rise from $187 to $933 — a 400 percent increase. A married couple with two children and an annual income of $25,000 saw their New York City benefit grow from $308 to $925 under the city payment — a 200 percent increase. In its first year, the expansion of the NYC EITC helped put an additional $280 million back into the pockets of more than 746,000 New Yorkers so they could better afford essential items like food, rent, and utilities.

“I was proud to champion the historic Earned Income Tax Credit expansion in Albany, which more than quadrupled the average family’s credit,” said New York State Assemblymember Jenifer Rajkumar. “We put $345 million in the pockets of almost a million working-class New Yorkers, enabling them to put food on the table, secure a roof over their heads, and stand on their own two feet. Today, we continue to bring economic empowerment and financial literacy to New Yorkers with the opening of the second Urban Upbound credit union right here in my home borough of Queens.”

“Community empowerment comes in many forms, with one of the most impactful being financial sustainability. Urban Upbound offers just that through its federal credit union services, and I couldn’t be more excited to welcome its second such branch to Western Queens,” said Queens Borough President Donovan Richards Jr. “For the families of Western Queens who have historically been marginalized and disinvested in, this is a monumental step forward in terms of financial literacy, equity and empowerment. Congratulations to my friend Bishop Mitchell Taylor and the entire team at Urban Upbound on this historic day. I look forward to working with all our city and community partners as we put more families on a more stable financial footing.”

“During my tenure as commissioner of DCWP, we launched an unprecedented campaign for the EITC initiative, which returned over $260 million to hardworking New Yorkers,” said New York City Councilmember Julie Menin. “The enhanced EITC has returned even more taxpayer dollars and directly addresses economic inequality in our city. I appreciate that Mayor Adams’ administration is prioritizing this tax credit, which has lifted up hundreds of thousands of hardworking families.”

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact