New apartments and other multifamily buildings have eased rental prices in the U.S., but many more are needed to help tackle America’s struggle with housing affordability, housing researchers say.

Economic and financial conditions are making the task a challenge. And many of the homes getting built are aimed at the upper end of the market, raising concerns about how much they can address affordability.

The average rent nationwide was $1,653 a month in May 2024, its highest level since October 2022.

More homes may bring down rents. Completed multifamily units, or buildings multiple families can live in such as apartments, duplexes and townhomes, reached their highest level in three decades when 449,900 hit the market in 2023, according to the Joint Center for Housing Studies of Harvard University. The number of finished multifamily units in March 2024 was also near a record high.

Harvard said the multifamily units have outnumbered sizable upticks in new renter households, cooling the rental market slightly.

Vacancies in professionally managed apartments rose to 5.9% at the start of 2024, more than twice the record low of 2.5% in early 2022, according to property-management software provider RealPage.

Still, financial headwinds are presenting difficulties to getting more multifamily housing on the market to ease rents.

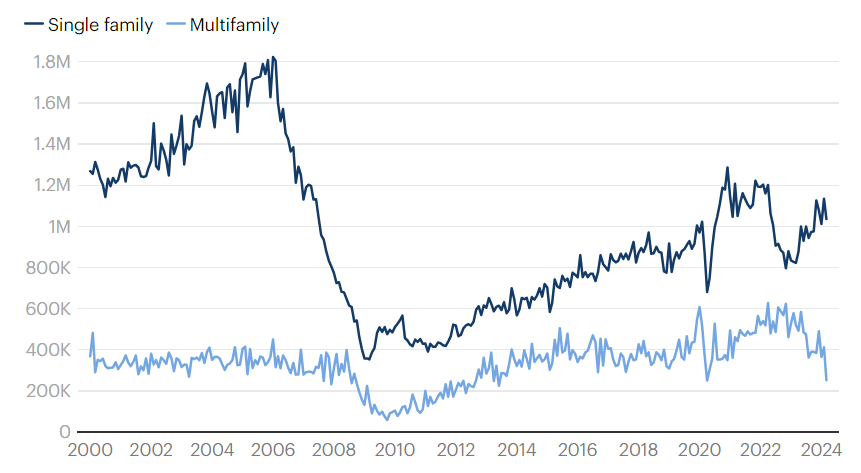

While single-family construction strengthened through 2023, construction starts of multifamily units fell 14% to 472,300 units last year, Harvard researchers said.

Single-family home construction is rising while multifamily construction is falling

Hover over lines for data and number of construction starts

Even so, completions of multifamily units will remain elevated for a time with 950,000 units under construction as of March 2024, slightly lower than the record-high of 1 million units in 2023, Harvard said.

“Wage growth is high and the nearly 1 million new multifamily units currently under construction will soon come online, suppressing rent growth.

But subdued rent growth will not last long,” the study’s authors wrote. “New construction starts are dropping rapidly, and financial conditions are increasingly impeding multifamily development projects.”

Financial challenges

Rental properties aren’t turning out the cash they used to, making them less attractive to developers and investors. Costs for running rental properties have risen 7.1% year over year as of Jan. 2024, driven by a 27.7% increase in homeowner insurance premiums, according to real estate research firm Yardi Matrix.

The cost increases have helped send apartment property prices down in 2023 for their first time in more than a decade. By March 2024, apartment prices were falling 8.4% year over year, according to Real Capital Analytics.

Who are these apartments for?

Most of the apartments and other multifamily units arriving on the market don’t come cheap.

Harvard said 97% of the multifamily units started last year were built for rent and and 87% were in buildings with at least 20 units, a type of property that tends to have some of the highest rents.

The median asking rent for the units finished in the first quarter of 2023 was $1,710, up from $1,690 in 2019 and $1,440 in 2014, Harvard said. Some 68% of new multifamily units were located in large metros in the fourth quarter of 2023, including 38% those metros’ core counties, according to the NAHB Home Building Geography Index.

“These units command higher asking rents in part because of the rising costs of land, building materials, and labor, and also because of where they are built and the amenities they increasingly offer,” Harvard said.

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact