In the real estate industry, mortgage professionals constantly face the ongoing challenge of generating new leads and nurturing existing ones.

To overcome this challenge, leveraging a Mortgage Customer Relationship Management (CRM) tool has proven to be one of the strategies. By combining the capabilities of a CRM with lead generation techniques, mortgage professionals can greatly enhance their efficiency, effectiveness, and overall success rate. In this post, we will delve into how a Mortgage CRM and lead generation can synergize to create a winning combination in the mortgage industry.

The Power of Mortgage CRM

The best CRM for mortgage is a software solution designed to streamline and automate aspects of mortgage origination, processing, and servicing. It offers mortgage professionals a hub where they can efficiently manage their leads, access vital client information, organize loan files, track communication history, handle tasks seamlessly, and much more. With all data stored in one place, mortgage professionals are able to save time on administrative tasks while prioritizing building strong relationships with their clients.

Lead Generation Techniques

In order to achieve growth within the mortgage industry, generating high-quality leads is paramount. While traditional methods such as referrals continue to be sources for acquiring business opportunities, integrating lead generation techniques into your marketing strategy can yield remarkable results. There are methods worth considering:

1. Content Marketing: One effective strategy is to create blog posts or articles that are relevant to potential homebuyers or refinancers. This not only establishes you as an expert but also attracts leads who are interested in learning more.

2. Social Media Advertising: Platforms like Facebook and Instagram provide targeting options, allowing you to reach demographics or geographic areas with compelling ad campaigns focused on mortgage services or incentives.

3. Paid Search Advertising: By utilizing services like Google Ads, you can display targeted ads to borrowers as they search for related keywords such as “mortgage rates” or “home loans.”

4. Landing Pages: Creating landing pages that highlight offerings or promotions can be a powerful way to capture visitors’ contact information through enticing offers like free guides or consultations.

5. Webinars and Seminars: Hosting webinars or local seminars not only helps establish your credibility but also provides an opportunity to collect attendees’ contact information for follow-up purposes.

6. Partnerships: Collaborating with real estate agents, financial advisors, and other professionals who cater to the target audience can significantly expand your reach and generate high-quality leads through credible referrals.

Integration with Marketing Automation

The true magic happens when mortgage professionals combine marketing automation with a Mortgage CRM system. Here’s how it works:

1. Centralized Lead Management: A Mortgage CRM enables mortgage professionals to gather, store, and organize leads from sources (websites, social media campaigns, landing pages) in one location. By utilizing a platform to manage these leads efficiently, you can streamline your follow-up process and ensure no opportunities slip through the cracks.

2. Cross-Channel Communication: By integrating a Mortgage CRM system, you can automate communications using email templates or text messages to nurture your leads. These communications can be triggered based on events or actions taken by the leads, helping you stay top of mind throughout their home-buying journey.

3. Tracking and Analytics: Most Mortgage CRMs offer tracking and analytics capabilities that provide insights into lead behavior and preferences. By analyzing this data, you can refine your lead generation efforts further and tailor your offerings to meet the needs of different segments of your target audience.

4. Task Automation: Using task automation features, a Mortgage CRM allows you to automate tasks like loan status updates or appointment reminders. This not only saves time but also ensures consistent communication with your clients, fostering stronger relationships.

5. Workflow Management: Having a Mortgage CRM system in place allows mortgage professionals to create personalized workflows that guide them through each step of the loan origination process. Starting from the contact all the way to closing the deal and beyond, it helps track anticipated milestones and prompts necessary actions to build strong customer-centric relationships.

6. Enhanced Customer Service: A Mortgage CRM empowers mortgage professionals to deliver customer service by documenting all interactions, keeping track of deadlines, and quickly accessing historical data. This gives you the ability to anticipate your client’s needs, proactively address any issues, and provide updates throughout the loan process.

Conclusion

In today’s paced and competitive mortgage industry, leveraging the power of a Mortgage CRM combined with lead generation techniques is crucial for achieving success. By integrating a Mortgage CRM with your lead generation efforts, you can centralize your lead management, automate communication and tasks, gain insights through analytics—and ultimately expand your business while delivering exceptional customer service. Whether you’re an independent mortgage professional or part of an organization, embracing this winning combination can strengthen your market presence and drive sustainable growth in today’s dynamic mortgage landscape.

- Statement From Senator Cordell Cleare On The Killing Of Robert Brooks At The Marcy Correctional Facility

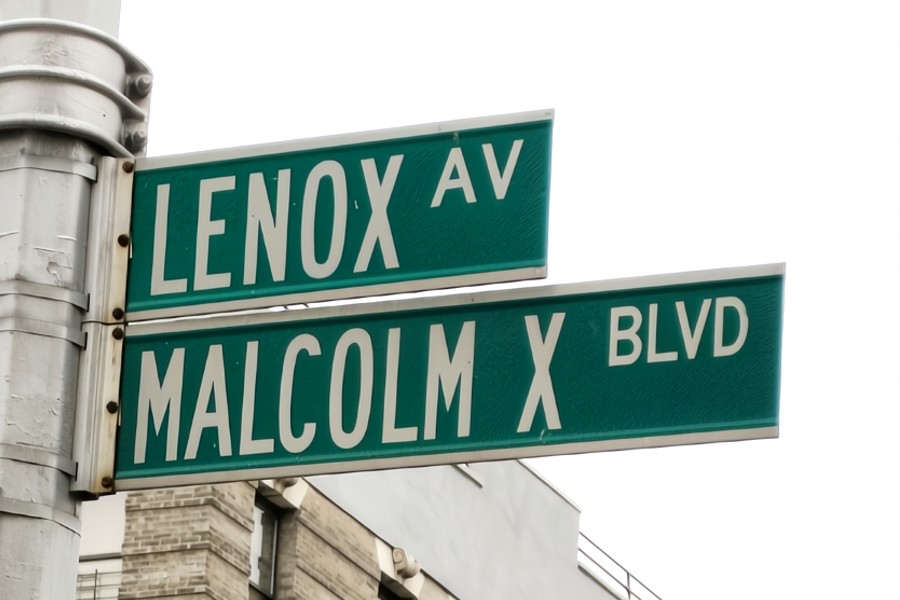

- Harlem’s Heartbeat: A Symphony Of American Dreams

- Mayor Adams Launches “Founded By NYC” To Celebrate City’s 400-Year History And Culture

- Improving Global Surgical Care Through The Alliance For Global Clinical Training

- How To Choose The Best NYC Office Movers For Your Business

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact