New York City Mayor Eric Adams today was joined by elected officials and community leaders to celebrate the enhancement of the Earned Income Tax Credit (EITC) in the state budget.

New York City Mayor Eric Adams today was joined by elected officials and community leaders to celebrate the enhancement of the Earned Income Tax Credit (EITC) in the state budget.

The EITC enhancement was part of a campaign pledge from the administration to bolster the social safety net and expand services for working families in New York City.

At today’s event, Mayor Adams announced over 800,000 families will benefit from the enhancement. Additionally, the city committed to investing $250 million annually to EITC and will receive a one-time state payment estimated at $100 million.

“Earlier this year, I told New Yorkers I would fight for them by expanding the Earned Income Tax Credit. Today, we say to New Yorkers: promises made and promises kept,” said Mayor Adams. “The additional $250 million annually in EITC reaches 800,000 New Yorkers — putting money back in their pockets for food, bills, and rent. Too many working families suffered because of COVID-19, losing wages and falling through our social safety net. With this critical expansion, we are making sure no one falls through the gaps again.”

“The Earned Income Tax Credit enhancement is this administration’s continued commitment to work on behalf of working families,” said Deputy Mayor for Strategic Initiatives Sheena Wright. “We will continue to fight for New York City families to have access to the social services needed to thrive and survive — from EITC to child care. We thank our colleagues in Albany for their partnership and commitment to rebuilding our social safety net.”

“For our city to move forward with an equitable recovery, we must invest in our working families and, thanks to Mayor Adams’ leadership and partnership with lawmakers in Albany, New York City is doing just that,” said Department of Consumer and Worker Protection Commissioner Vilda Vera Mayuga. “By increasing the amount of the Earned Income Tax Credit to be in line with the reality of today’s cost of living, we are putting money in the pockets of hardworking New Yorkers. Each year, NYC Free Tax Prep helps families file for the EITC, and we see the relief this credit brings to families as they pay bills, find childcare, and buy groceries. I thank Mayor Adams for being a champion of this effort!”

The state and city match to EITC had not previously been increased in almost 20 years.

Under the city’s expansion of the EITC, a single parent with one child with an income of $14,750 will see their benefit increase from $181 to $905 — a 400 percent increase.

A married couple with two children and an income of $25,000 will see their New York City benefit increase from $299 to $897 under the city payment — a 200 percent increase.

The expansion of EITC will help the 800,000 New Yorkers who qualify to better afford essential items like food, rent, and utilities, and will supercharge New York City’s economic recovery.

“This is fantastic news for working families across New York, especially in New York City,” said U.S. Representative Jerrold Nadler. “The Earned Income Tax Credit enhancement will go a long way toward ensuring all New Yorkers have continued access to the services they rely on. While our state continues to navigate its way out of this pandemic, it is more important than ever to make sure working families have the support they need.”

“The Earned Income Tax Credit enhancement is a huge benefit for working New York families,” said U.S. Representative Carolyn B. Maloney. “Every New Yorker deserves to have access to social services they need to flourish. Thank you, Mayor Adams, for prioritizing the reinforcement of this social safety net.”

“The EITC will go a long way in helping over 800,000 working families across New York City,” said U.S. Representative Nydia Velázquez. “I want to thank the state legislature for including this measure in the budget and reaffirming New York’s commitment to helping families.”

“This state and city match to EITC in the state budget is the right move on behalf of all New Yorkers. At long last, families will get to see a well-deserved enhancement to the Earned Income Tax Credit they depend on,” said U.S. Representative Yvette Clarke. “Our state’s working families have faced impossible challenges over recent years, from a deadly pandemic, the affordable housing crisis, back-to-back natural disasters, to a debilitating economic setback. This tax credit boost from the city will not only help hard-working families reach a place of stability, it will also invigorate our local economies, and I am ever more grateful to Mayor Adams, and our colleagues in Albany, for fulfilling the oath to improve the lives of all New Yorkers and help alleviate some of the challenges they face.”

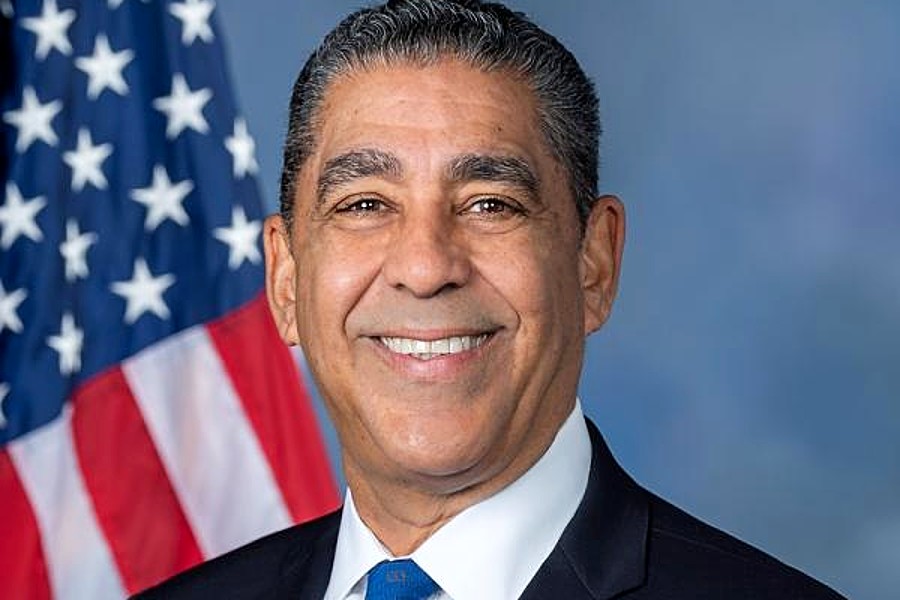

“Families around the nation have faced numerous challenges as a direct result of the COVID-19 pandemic,” said Harlem U.S. Representative Adriano Espaillat. “Many have relied on the critical resources provided through our comprehensive social safety net to make ends meet and stay afloat during this crisis. Enhancing the Earned Income Tax Credit in the state budget will provide over 800,000 families the support they need as they continue to work towards revitalization post-pandemic. I commend all who worked to make this historic investment possible to help further our efforts to ensure all New Yorkers can equitably participate in the economic recovery of our city and state.”

“The best way the state can support our working families is simple: put dollars and cents back into their pockets — and that’s exactly what the Earned Income Tax Credit does,” said New York State Senator Brad Hoylman. “New York families are hurting after a two-year-long pandemic, and this year’s budget demonstrated our government’s dedication to uplifting our state’s children and working caregivers. With this new measure, we are giving families a bit more room to breathe and choose what is best for their family’s needs, whether it’s putting food on the table or books in backpacks. I am very grateful to my colleagues in Albany for supporting the critical move, which is almost 20 years in the making.”

“Enhancing the Earned Income Tax Credit is long overdue,” said New York State Senator Toby Ann Stavisky. “This funding provides vital support for hundreds of thousands of city residents struggling to pay their rent or put food on their tables. Increasing the EITC is just one example of how our newly passed state budget invests in the needs of New York’s working women and men.”

“Working families always need help, and in the post-COVID world, this cannot be any truer, which is why I fought and, with my Senate colleagues and leadership, expanded the credit to cover many more working New York families,” said New York State Senator Diane Savino. “The Earned Income Tax Credit is critical to working families, and the recently passed New York State budget approved the first expansion to New York City’s EITC in nearly a generation — the city’s EITC will increase from 5 percent of federal benefits to 30 percent.”

“The enhancements and expansion of the Earned Income Tax Credit, which were included in the budget, are much needed and will allow so many more New Yorkers to benefit from the program,” said New York State Senator James Sanders, Jr. “Each year, millions of low- and moderate-income workers across the country claim EITC, a federal tax benefit worth billions of dollars. This tax credit program has helped working individuals and families by reducing taxes, supplementing their wages, and providing financial stability.”

“The Earned Income Tax Credit enhancement that was included in this year’s state budget will provide much-needed relief for many hard-working New Yorkers when they need it the most,” said New York State Senator Simcha Felder. “The EITC has a long history of helping low- to moderate-income working families, and by expanding this critical tax credit, we are putting more money in the pockets of struggling New Yorkers.”

“All families have been affected in one way or another by the pandemic,” said New York State Senator Luis Sepúlveda. “But of particular concern for working families, especially in my district in the South Bronx, the Earned Income Tax Credit enhancement is a breakthrough and a circumstantial relief for these working families. This tax relief provides help that can be used to cover living expenses and put more money in families’ pockets so they can meet the economic challenges they face.”

“I was proud to have fought for a larger Earned Income Tax Credit in the recently concluded state budget process, which will help low- to moderate-income New York families fighting inflation,” said New York State Assemblymember Helene Weinstein, chair, Committee on Ways and Means. “I also applaud Mayor Adams for the city’s expansion of EITC. Together these actions will provide significant additional relief for families who need it most.”

“The EITC expansion will help lift many New Yorkers out of poverty and get families hit hardest by the pandemic back on their feet,” said New York State Assemblymember Rodneyse Bichotte. “I applaud my Democratic colleagues in Albany for voting with me in favor of this measure, which will provide financial security to nearly a million families, and I thank the mayor for committing additional funds towards correcting the tax system’s many imbalances and helping families meet their most basic needs.”

“It’s extremely imperative that we address the needs of our great city and state to provide support where it will make a greater impact for families. The Earned Income Tax Credit enhancement is a pivotal milestone that will issue much-needed tax credits to working families and children,” said New York State Assemblymember Maritza Davila. “As we move forward, post-pandemic, we must not forget the economic inequalities that lead to food and financial insecurity — which many working families experienced firsthand. The tax credit is a direction towards economic development but most importantly to ensure families have access to basic human necessities such as food, water and the ability to afford and pay rent.”

“The 2022-23 state budget invests in our families and ensures that all New Yorkers have the tools and resources they need to succeed,” said New York State Assemblymember Charles Fall. “From education to earned income tax enhancement to childcare and housing, the state budget addresses the core issues that New Yorkers worry about on a daily basis. I am proud that we were able to craft a budget that will make a real impact and help so many of our communities.”

“The pandemic was hard on working families in every corner of our city, and we cannot leave them behind in our comeback,” said New York State Assemblymember Eddie Gibbs. “With the earned income tax credit enhancement, hundreds of thousands of New York families will have an easier time putting food on the table, paying for rent, and funding childcare, among paying for other everyday expenses. I am so appreciative to have a partner in Mayor Adams who shares the goal of investing in working families with an expanded social safety net.”

“When you have a mayor like Eric Adams who ‘Gets Stuff Done,’ we all want to ‘Get Stuff Done,’” said New York State Assemblymember Jenifer Rajkumar. “My Albany colleagues and I did exactly that when we expanded the EITC in this year’s budget bill, putting more money in the pockets of hundreds of thousands of working-class New Yorkers. Our expansion will be the lifeline that so many New Yorkers need for putting food on the table and having a roof over their heads. On top of that, the enhanced EITC will act as a force multiplier for all of Mayor Adams’ work to eliminate poverty in our city.”

“As we continue the fight for working families and bringing the resources to our community, I want to thank my colleagues in the Assembly and Speaker Heastie for including the enhancement of the Earned Income Tax Credit in this year’s state budget,” said New York State Assemblymember Yudelka Tapia. “For too long our New York City families have lacked the proper social safety net that is needed to afford a quality lifestyle. With this new expansion of EITC we will be able to assist 800,000 qualifying New Yorkers to receive their essential living needs. This not only will help our deserving families but also help our economy continue to recover.”

“The COVID-19 pandemic and resulting economic devastation has forced far too many families in Queens and across New York City to make incredibly difficult decisions in order to make ends meet and support their families. This enhancement of the Earned Income Tax Credit means more money in the pockets of hard-working families throughout the five boroughs and a stronger overall economic recovery for our city,” said Queens Borough President Donovan Richards Jr. “Thank you all our elected partners and community advocates who successfully pushed for this critical tax credit enhancement, as we fight for a stronger, fairer city.”

“The enhancement of the Earned Income Tax Credit in the state budget is a much-needed boon for New York City’s working families,” said New York City Council Speaker Adrienne Adams. “As costs and expenses continue to rise, the increased benefit will make a tangible difference in the lives of more than 800,000 New Yorkers. We will keep focusing on ensuring an equitable recovery and supporting families through critical investments and programs. I thank my colleagues in state government for prioritizing the expansion of the EITC and improving the lives of so many New Yorkers.”

“The Earned Income Tax Credit strengthens our entire economy and ensures individual New Yorkers are given more financial opportunity,” said New York City Councilmember Marjorie Velázquez, chair, of Committee on Consumer Affairs and Worker Protection. “I applaud Mayor Adams’ administration’s efforts to provide security for our working families and our state partners for dedicating funding to help our communities.”

“This is sound fiscal policy, as data has shown that an expanded Earned Income Tax Credit will provide much more bang for your buck than other types of stimulus programs, provide a boost to the local economy, and help struggling families meet basic needs at a time of soaring inflation,” said New York City Council Minority Leader Joe Borelli.

“This credit will go straight to the New Yorkers that need it most, giving our city a huge boost in the midst of recovery,” said New York City Councilmember Shaun Abreu. “Families will see more money in their pocket for the first time in 20 years. As chair of the Council’s Committee on State and Federal Legislation, I applaud the partnership between Mayor Adams and Governor Hochul to deliver for hard-working New Yorkers.”

“I commend Mayor Adams for working with the state legislature and the governor to secure an enhancement of the Earned Income Tax Credit in the budget for New York City’s working parents and families,” said New York City Councilmember Gale A. Brewer. “By ensuring that families have more resources for items like food, child care, and rent, we make a real impact in fighting poverty. It is crucial that qualifying taxpayers are aware of this benefit.”

“The Earned Income Tax Credit is going to put actual money in the pockets of hard-working New Yorkers, and it couldn’t come at a more impactful time,” said New York City Councilmember Eric Dinowitz. “The pandemic has not only impacted our health, but it has also impacted our livelihoods, and our government must step up to help. I extend my gratitude to Mayor Adams for his advocacy and to our representatives in Albany for making the EITC a budget priority.”

“I applaud this enhancement of the Earned Income Tax Credit,” said New York City Councilmember Robert Holden. “As we emerge from the pandemic, working-class New Yorkers need all the relief they can get, and it was long overdue for an increase. Any measure that eases the burden of New York taxpayers is a welcome change.”

“I applaud both the state and city for their significant investments into EITC — one of the best, proven, and effective tools to fight poverty and to support our working families,” said New York City Councilmember Ari Kagan. “Special thanks to Governor Kathy Hochul and Mayor Eric Adams in making sure 800,000 families in our city will benefit from the enhancement of this popular program. I know this important step will help many of my constituents and families all over the city during this difficult post-pandemic recovery. It will also help many struggling small businesses, because EITC recipients will spend this additional money in local stores improving our economy.”

“The monumental increase to the Earned Income Tax Credit is a huge relief for over 800,000 New Yorkers struggling to make ends meet,” said New York City Councilmember Farah Louis. “While the increase may seem like a small amount, every dollar counts as our city tackles a difficult economic situation in the wake of the COVID-19. This will especially help low-income New Yorkers stay afloat. Thousands of immigrant and minority families rely on the small breaks to put food on the table, keep a roof over their heads, and afford utilities. It is essential we expand the scope of our social safety net so our neighbors do not fall through the economic cracks.”

“The Earned Income Tax Credit enhancement has helped so many New Yorkers, and the expansion of this credit to meet the current and growing needs of families during the city’s pandemic recovery is of paramount importance,” said New York City Councilmember Julie Menin. “As the former commissioner of the Department of Consumer and Worker Protection, we launched an initiative to connect New Yorkers with over $260 million in credits, and now, today, this expanded credit will provide an additional social safety net to include more families in need making a true difference in fighting inequality.”

“Low-income working families have long relied on the Earned Income Tax Credit, and that the state and city will increase funding allocations will bring much relief to our communities during a critical time,” said New York City Councilmember Pierina Sanchez. “Around 70 percent of low-income families in this city are one economic shock away from instability, falling behind on rent and losing their homes, or not having access to food. Increased funding to the Earned Income Tax Credit will help lift more families out of poverty, so they can thrive and recover. With a median income of $21,000, the Earned Income Tax Credit brings highly-needed relief for District 14 neighbors and residents.”

“The enhancement of the Earned Income Tax Credit in the state budget is important in our dedication as a city to fight to ensure there is equity for all our families within our communities,” said New York City Councilmember Althea Stevens. “Making the EITC enhancement an annual investment is an essential step in creating financial sustainability for all our families.”

“The provision of free VITA Tax Services at Restoration has been particularly important this year, as we have helped clients access missed Child Tax Credit and stimulus payments, leading to an increase in critical funds returned to families,” said Tracey Capers, executive vice president and chief of programs, Bedford Stuyvesant Restoration Corporation. “With support from the Department of Consumer and Worker Protection, Bedford Stuyvesant Restoration Corporation provides year-round free tax services, and we encourage all clients, particularly those that have not filed for several years, to take advantage of our free tax services, which are available on a walk-in basis until June 10. After that date, appointments can be made at 718-636-6994.”

“We applaud Mayor Adams for his hard work and determination in ensuring that more than 800,000 New Yorkers will benefit from the New York City and New York State EITC increases and the NYS Empire Child Tax Credit in the State Budget,” said Louis Weltz, CEO, COJO Flatbush. “As CEO of a busy Brooklyn-based social services agency, I know firsthand how much our working families stand to gain from the mayor’s achievement. Thank you, Mr. Mayor.”

“The volunteers and staff of the NYC Free Tax Prep service at Grow Brooklyn are proud to have supported Mayor Adams’ efforts to advocate for residents of New York City to facilitate increases of the city and state Earned Income Tax Credit and the NYS Empire Child Tax Credit in the state budget,” said Makeela Brathwaite, executive director, Grow Brooklyn. “These tax credits go a long way to improve the lives of those living under poverty and the working poor individuals and families through critical, refundable tax credits. The mayor’s work to provide these credits will help many more communities in the upcoming tax year. We look forward to assisting in this effort to reach even more taxpayers.”

“It’s clearer than ever that the best ways, by far, to fight poverty and hunger are to reward work and enable struggling people to obtain more cash to help them pay their bills,” said Joel Berg, executive director, of Hunger Free America. “Mayor Adams is right on target in proposing for the city to expand the local Earned Income Tax Credit that accomplishes exactly that.”

“At Neighborhood Trust, we applaud the New York state and city’s expansions to EITC and CTC for New York’s working families,” said Justine Zinkin, CEO, of Neighborhood Trust Financial Partners. “As a provider of direct financial coaching solutions, we see firsthand that these low-income workers and their families are continually forced to turn to debt just to make ends meet, primarily as a result of low wages and insufficient benefits, alongside rising costs of living. This year’s expanded tax credits are critical for enabling working families to tackle their debts, balance cash flow, build cash reserves for unexpected expenses, and begin saving for their long-term goals.”

“The single best way to fight poverty is by putting dollars directly back in families’ bank accounts,” said Rachel Sabella, director, No Kid Hungry New York. “I can’t underscore enough how beneficial this expansion of the Empire State Child Tax Credit and the New York City Earned Income Tax Credit will be for families in New York, particularly those hardest hit by the health and economic crisis of the past two years. We applaud Mayor Adams for prioritizing this key policy expansion to help families and thank Governor Hochul and the New York state legislature for their commitment to fighting poverty in every corner of our state.”

“Today is a day for celebration. An expanded New York City Earned Income Tax Credit has been long overdue and will do so much good for our fellow New Yorkers. I applaud Mayor Adams for his leadership and tenacity on this issue,” said Plinio Ayala, president, and CEO, Per Scholas. “As a leading tech skills trainer here in New York City, I know firsthand just how many of our Per Scholas learners rely on the Earned Income Tax Credit, enabling them to participate in training like ours to skill up for a high-growth career and future prosperity.”

“The lasting effect of COVID-19 has drastically grown the need to expand the Earned Income Tax Credit and the Child Tax Credit across cities and states, especially for Black and brown families facing disproportionate impacts daily,” said Gary Cunningham, president, and CEO, Prosperity Now. “Through the Economic Recovery Blueprint led by Mayor Adams, in partnership with state lawmakers, New York is providing a stepping stone to ensure that state and local leadership commits to action by increasing New York City and New York state’s EITC as well as the New York State Empire Child Tax Credit, further growing economic tax relief for New York families.”

“EITC and the New York State Empire Child Tax Credit are critical tools to fighting childhood poverty,” said Hugh Parry, president, of United Way of New York State. “United Way of New York State is proud of the work done by 211 and 311, connecting New Yorkers to VITA free tax preparation services enabling families to access these dollars without fees. The struggle doesn’t end simply by crossing the poverty line — recognizing that, United Way, 211, 311, and volunteers across the state are helping low- and moderate-income families keep more dollars in their pockets this tax season. For more information on free tax preparation services anywhere in the tri-state area, call 211.”

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact