Today, the New York Immigration Coalition (NYIC), elected officials, member organizations, impacted individuals and immigrant New Yorkers held a press conference at Mixteca to launch the Working Families Tax Credit 2024 NYS Legislative Campaign.

New Yorkers are struggling with the high cost of living. The costs of housing, child care, utilities, and basic living needs have pushed many working families into a financial crisis. By making some changes to our tax code, we can give economically burdened workers and families cash to pay for the basic essentials that all New Yorkers need: food, rent, utilities, child care, and more. The Working Families Tax Credit (S277A Gounardes / Hevesi A4022A ) is an expanded, improved refundable tax credit that combines the Empire State Child Credit (ESCC), the Earned Income Tax Credit (EITC), and the dependent exemption (DE) into one bigger, better credit.

Liza Schwartzwald, Director of Economic Justice and Family Empowerment, New York Immigration Coalition, “New Yorkers are facing a daunting affordability crisis with no real end in sight, as working families struggle to pay for housing, groceries and child care. And when families can’t make ends meet, our entire economy suffers. Putting cash in the hands of more New York families through the tax credit system allows them to bridge that gap and better meet their financial obligations. The Working Families Tax Credit will improve the lives of nearly every New York family with children – regardless of their immigration status – helping them keep afloat so they can give their kids the best opportunity to succeed. Turning this bill into law is imperative in building a future for our State where immigrant and low-income families can thrive, while contributing to our collective economy and culture.”

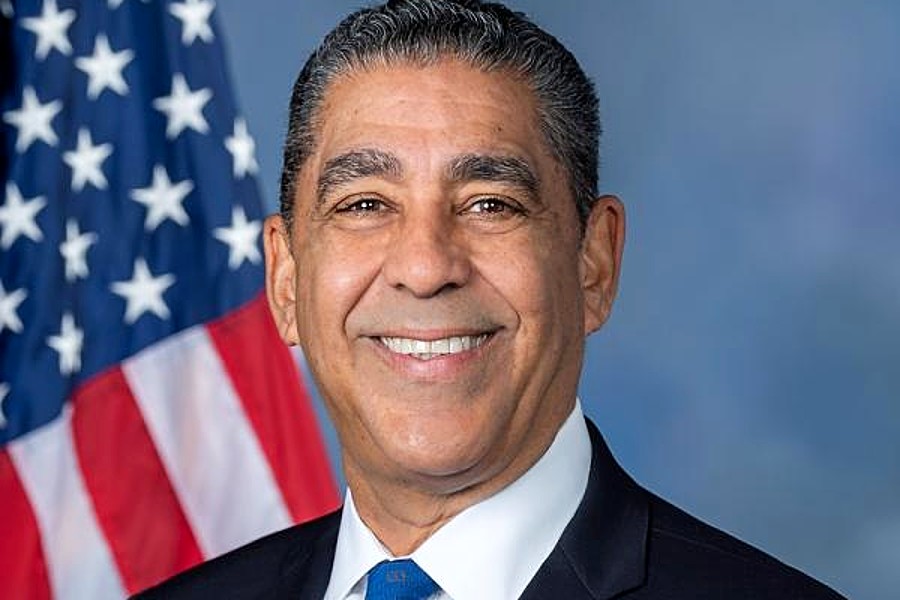

Senator Andrew Gounardes, District 26, “A wise man once said, ‘If you can make it here, you’ll make it anywhere.’ But if we want New York to be a place where working families have a real shot at making it, we have to give them the resources to take that shot. My Working Families Tax Credit will give New Yorkers the support they need to afford essentials for their kids, whether that be diapers, clothes, or rent to keep the roof over their head. When the federal government temporarily increased its child tax credit, child poverty plummeted. Now that the federal program has expired, it’s time for New York to step up and do right by working families.”

NYC Council Member Alexa Avilés, District 38, “At a time when our millionaires are growing and our reserves reach near-record levels, we should be doing everything in our power to encourage working families to put down roots in our city. We need legislation like the Working Families Tax Credit at the state level and the Child Tax Credit at the national to prove that we are not all talk on our commitments to keep families here. I’ve been pushing hard for Resolutions 417 and 500 to get our city on the record in support of these common sense policies. Thank you Senator Gounardes for leading the charge in this fight on behalf of New York state’s working families.”

Larry Marx, CEO, The Children’s Agenda, “The majority of burdens children bear are preventable. Child poverty, inadequate and unstable housing, untreated medical conditions – these are not failures of children or families. They are failures of our systems. We know what kids need most and what works best. One of the most effective and efficient ways of providing children what they need to thrive is by keeping more of their families’ hard-earned money in their pockets. The Working Families Tax Credit does precisely that. New York has the resources to support children in a way that will help meet all of their needs. The only question is if we have the political will.”

Larry Marx, CEO, The Children’s Agenda, “The majority of burdens children bear are preventable. Child poverty, inadequate and unstable housing, untreated medical conditions – these are not failures of children or families. They are failures of our systems. We know what kids need most and what works best. One of the most effective and efficient ways of providing children what they need to thrive is by keeping more of their families’ hard-earned money in their pockets. The Working Families Tax Credit does precisely that. New York has the resources to support children in a way that will help meet all of their needs. The only question is if we have the political will.”

David R. Jones, President and CEO, Community Service Society of New York, “For far too long New York’s families have been struggling to make ends meet, as rising costs and increasing inequality have pushed them to the brink. That’s why we are proud to champion the Working Families Tax Credit which is designed to be a simplified and powerful tool to lift people out of poverty, improve their economic security and reach many more New Yorkers in need.”

Adam Ruben, Director of Economic Security Project Action, Economic Security Project, “Expanding the Working Family Tax Credit would provide New Yorkers what every working family across America needs: more money in their pockets. Last year New York was a national leader in expanding its credit, and this year lawmakers should continue to transform our tax system, advocating for equity and increased access. We are also eager to see how New York’s campaign sparks similar actions across the country.”

Jenn O’Connor, Director of Partnerships and Early Childhood Policy, The Education Trust-NY,

“The Education Trust–NY supports the Working Families Tax Credit because it will put money into the hands of families who need it most, particularly those with very young children. Families often use these tax credits to pay for basic needs including diapers, formula, clothing, and child care. The Working Families Tax Credit will make getting that money easier by streamlining several tax credits into one. We urge lawmakers to pass the legislation this session.”

Brian Mendes, Director of Adult Literacy, Fifth Avenue Committee, “Nothing should be more important to us than ensuring that the parents and caretakers in our community have the minimum level of support necessary to attend to the basic needs of the children of this community. These families pay taxes. They work in our businesses and our schools. They have a right to a fair and inclusive tax policy. This bill would be a step toward that end. It is good for New York, it is good for NYC, and it is good for the families of Sunset Park.”

William Weisberg, Executive Director, Forestdale, Inc., “Forestdale serves families throughout Queens and Brooklyn from communities that struggle with the stresses of marginalization and poverty. Child poverty has devastating consequences. We can end it if we have the political will. The New York Working Families Tax Credit campaign takes one more step in that direction.”

Lorena Kourousias, Executive Director, Mixteca, “Mobilizing for economic justice, Mixteca Organization proudly supports the Working Families Tax Credit bill. This transformative legislation recognizes the diverse needs of our communities, providing crucial financial relief and empowerment to working families. By championing this bill, we aim to build a more inclusive and equitable future where every family can thrive.”

Kate Breslin, President and CEO, Schuyler Center for Analysis and Advocacy, “With New York’s child poverty rate persistently higher than the national average, and an ambitious target established that has committed the state to reduce child poverty by 50% over the next 9 years, it is essential for New York to prioritize poverty-fighting policies like the robust, targeted, fully refundable Working Families Tax Credit. The WFTC credit builds upon the strengths of New York’s Empire State Child Credit and Earned Income Tax Credit, and corrects their shortcomings. The path to ending child poverty requires proven policy solutions – the WFTC is a crucial step toward ensuring that every child in New York has the opportunity to thrive.”

The New York Immigration Coalition (NYIC) is an umbrella policy & advocacy organization that represents over 200 immigrant and refugee rights groups throughout New York. The NYIC serves one of the largest and most diverse newcomer populations in the United States. The multi-racial and multi-sector NYIC membership base includes grassroots and nonprofit community organizations, religious and academic institutions, labor unions, as well as legal and socioeconomic justice organizations.

The NYIC not only establishes a forum for immigrant groups to voice their concerns, but also provides a platform for collective action to drive positive social change. Since its founding in 1987, the NYIC has evolved into a powerful voice of advocacy by spearheading innovative policies, promoting and protecting the rights of immigrant communities, improving newcomer access to services, developing leadership and capacity, expanding civic participation, and mobilizing member groups to respond to the fluctuating needs of immigrant communities.

- LISC CEO Michael T. Pugh Recognized Among 2024 Worthy 100 Leaders

- NY Lawmakers Celebrate Historic MENA Data Recognition Bill Signed By Hochul

- Sponsored Love: Leadership Skills Training Courses: Invest In Your Future Today

- Senator Hoylman-Sigal Calls On Independent Schools To Adopt NYC Public School Calendar

- Mayor Adams Celebrates 65 Million NYC Visitors In 2024, Second-Highest Ever

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact