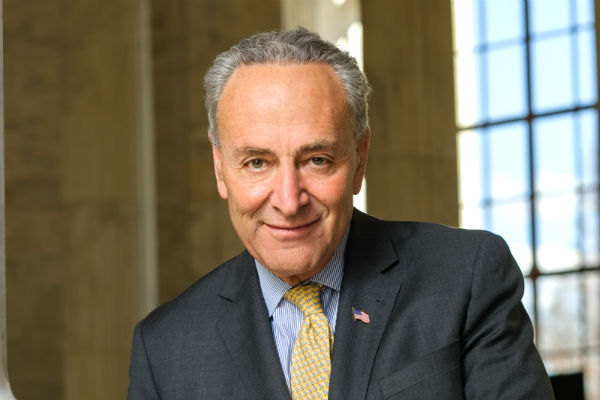

As Senate Majority Leader Chuck Schumer contemplates bringing antitrust legislation to a floor vote, a new economic impact analysis by the Computer & Communications Industry Association hits.

As Senate Majority Leader Chuck Schumer contemplates bringing antitrust legislation to a floor vote, a new economic impact analysis by the Computer & Communications Industry Association hits.

It reveals that proposed regulations in antitrust bills like S. 2992 and H.R. 3816 would come at a major cost for U.S. investors and pension plan members such as teachers, firefighters, and nurses.

CCIA has created an interactive map that displays the expected aggregate and individual losses for public sector workers on a state-by-state basis. The Day 1 impact per New York pension plan member is estimated at $663.20 with a long term impact of over $6001.52.

Troubling findings show that by the late 2030s, increased operating costs for companies regulated by the proposed legislation would reduce their market value significantly, causing up to $109 billion in losses to public sector pension plans and $1.02 trillion to investors in S&P 500 index funds and large cap firms.

“Tech regulatory bills like S. 2992 and H.R. 3816 would cost U.S. investors up to a trillion dollars from increased operating costs and reduced market value. Public sector worker pension plans are leading shareholders of companies that would be regulated under the bills and face losses up to $109 billion,” said CCI Director of Research and Economics Trevor Wagener. “As a result, for tens of millions of Americans who are members of such pension plans, the average expected harm is up to nearly $4,000 per person. Supporters of the bills have offered no quantitative economic analysis of the costs and benefits of the bills that show any quantifiable benefits for those Americans in return.”

The analysis extends a methodology used in a recent National Economic Research Associates (NERA) study that found that the bills would regulate five U.S. companies upon enactment, increasing their operating costs by $319 billion and reducing firm market value accordingly. In the near term, 13 additional U.S. companies would be regulated and incur losses.

By the late 2030s, over 100 U.S. companies would be regulated at a cost of up to $1.02 Trillion for U.S. investors.

The analysis reveals the particularly concerning impact the proposed regulations would have on public sector workers’ pension plans.

On average, 86% of public sector pension plans count 5 companies that would be immediately regulated by the bills among their top 10 holdings.

Virtually all of their top 10 holdings would be impacted by the 2030s, suffering up to $109 billion in losses, or up to $3,928 per pension plan member.

The Computer & Communications Industry Association has advocated for tech policy that advances competition and innovation for 50 years.

The following can be attributed to CCIA Director of Research and Economics Trevor Wagener:

“Tech regulatory bills like S. 2992 and H.R. 3816 would cost U.S. investors up to a trillion dollars from increased operating costs and reduced market value. Public sector worker pension plans are leading shareholders of companies that would be regulated under the bills and face losses up to $109 billion. As a result, for tens of millions of Americans who are members of such pension plans, the average expected harm is up to nearly $4,000 per person. Supporters of the bills have offered no quantitative economic analysis of the costs and benefits of the bills that show any quantifiable benefits for those Americans in return.”

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact