Paying bonuses to employees can be an effective way to reward performance, boost morale, and incentivize goals.

Properly administering bonuses involves understanding the different types, legal implications, and how to set them up in your payroll system. Even in these modern HR solutions, ADP stands as an indicator of proper payroll management.

Whether you are an HR professional looking for ways to align the payroll procedures or a business leader who is aiming to encourage and motivate employees, this guide will walk through the key considerations and processes for paying employee bonuses using ADP.

Understanding the Types of Bonuses

Bonuses are additional compensation awarded to employees beyond their regular wages. Companies have several options when it comes to the types of bonuses they can offer. The first step in knowing how to pay bonuses to employees adp is to understand the different categories that will help you decide which plans make sense for their needs:

Discretionary Bonuses

Discretionary bonuses are not announced in advance or tied to any specific criteria. Companies have full discretion over whether to pay them out and the amount. Common examples include holiday bonuses or spot bonuses for completing a project.

Common Examples

- Holiday bonuses

- Spot bonuses for completing a special project

- Loyalty bonuses for employees who have served long tenures

Benefits

- Allows flexibility in amounts and timing

- Can reward unique circumstances

- Boosts morale for surprise rewards

Nondiscretionary Bonuses

These bonuses are announced in advance and the conditions for earning them are clearly defined. Meeting a sales target or working for the company for a certain period are examples. These types of bonuses are used to encourage greater efficiency or employee retention.

Common Examples

- Performance bonuses for meeting sales targets

- Safety bonuses for reducing accident rates

- Retention bonuses for staying with the company for a certain period

Benefits

- Motivates employees to increase their productivity or other desired behaviors

- Rewards employee longevity and commitment to encourage them

- Helps attract new potential talent by advertising bonuses

Other Varieties of Bonuses

Along with the discretionary vs non-discretionary categories, some other bonus types companies offer include:

- Signing bonuses to attract candidates to join the company

- Referral bonuses for bringing in new hires

- Attendance bonuses for missing a few days

- Profit-sharing bonuses based on company earnings

- Spot awards for noteworthy accomplishments

Bonuses may be paid out in various forms like cash, stock options, PTO, gift cards, company swag, trophies, certificates, public recognition, or a combination.

The key is choosing bonus plans aligned with your business goals and culture. Understand the benefits of each type and consider blending different varieties to maximize motivation.

Companies may offer various bonus types like signing bonuses for new hires, referral bonuses for bringing in new employees, safety bonuses for reducing accidents, and more. Bonuses can be paid out in cash, company stock, extra paid time off, or other forms.

Legal Implications of Bonuses

While bonuses are a great incentive, they come with legal considerations including:

1. Taxation

In the United States, bonuses are considered supplemental wages by the IRS and are subject to federal income taxes. Employees must report bonuses as taxable income.

For bonuses up to $1 million, the federal tax rate is a flat 25%. State and local taxes also apply. Employers are responsible for withholding the appropriate taxes.

2. Overtime Calculations

For non-exempt employees, bonuses must be factored into overtime calculations for the workweeks they cover. The Fair Labor Standards Act has specific guidelines on this which we’ll cover next.

3. 1099 Reporting

In this situation of acknowledging bonuses, the companies are also held responsible for following the rules and one such rule is about 1099 reporting. Bonuses paid to independent contractors require 1099 reporting if annual payments exceed $600. This applies to both cash and non-cash bonuses.

Overtime Implications of Bonuses

For employees covered by the Fair Labor Standards Act (FLSA) overtime requirements, bonuses influence the regular rate of pay, which determines overtime. Here are some key considerations:

- Nondiscretionary bonuses must be included when calculating the regular rate for overtime pay. Discretionary bonuses do not need to be included.

- For a bonus covering a single workweek, add it to other compensation for that week then determine the regular rate.

- For bonuses earned over multiple workweeks, divide the bonus by the number of weeks and allocate it across the period.

- For an annual bonus, divide by 52. For a quarterly bonus, divide by 13.

- Make sure overtime rates for impacted workweeks are recalculated factoring in the bonuses.

Proper overtime calculation with bonuses can be tricky, so consult the DOL’s guidance if unsure. Tracking hours accurately is essential.

Setting Up Bonus Payments in ADP

Once you’ve decided on employee bonuses, you can set up payments properly in ADP:

- Select the bonus pay types you will offer – like discretionary, referral, safety, etc. ADP has preset options to choose from.

- Enter bonus plans into ADP, including eligibility criteria, payout frequency, and other rules. Set deadlines for submission if employees must qualify.

- When it comes time to pay bonuses, enter the amounts for each employee into ADP’s bonus pay entry tool.

- Confirm ADP is calculating taxes on the bonuses correctly based on supplemental wage rates. Update employee W-4s if needed.

- Submit the bonus payment batch to payroll so amounts get included in paychecks on the desired date.

- Communicate bonus payments clearly to employees so they know the amounts and understand why they are getting them.

Best Practices for Bonus Payments

Follow these recommendations for a smooth bonus process:

- Financial Planning – Review your budget beforehand so you can set appropriate bonus amounts. This ensures that the bonus payment fits the financial capacity of the organization.

- Eligibility and Metrics – Set clear eligibility criteria and performance metrics for non-discretionary bonuses. These boundaries are not just for ensuring fairness when it comes to nondiscretionary bonuses but also align the decision-making process.

- Documentation – Ensure managers document why discretionary bonuses are given out. Documenting provides more clarity and transparency, ensuring that the basis for such bonuses is justifiable.

- Communication – Train managers on how to communicate about bonuses to manage expectations. Emphasize bonuses are discretionary and are based on such factors as success in the organization and overall performance.

- Accuracy and Approval – Double-check bonus amounts and taxes before processing payroll. Have an approval step.

- Timing – Issue bonuses on off-cycle pay dates instead of regular payroll if possible. This aids reporting. This approach minimizes the complexities and ensures the accuracy of financial reporting.

- Alignment with ADP – Confirm ADP has the compensation types needed to track bonus expenses accurately for financial reporting. Make sure that the software aligns with the bonus structure of your organization and guarantees proper financial reporting.

Final Thoughts

Paying out employee bonuses requires understanding the different bonus types, tax and overtime implications, and how to set them up properly in your payroll system like ADP. Following the recommendations in this guide will help you administer bonus programs that motivate employees while remaining compliant. Reach out to your payroll provider or HR advisor with any questions. Keep in mind that providing a clear understanding to the employees about the bonus, accurately calculating, documenting, and reporting are some of the most important steps to a successful bonus process of an organization.

- How To Use Bitcoin ATM From Harlem To Hollywood

- How To Prepare Financially During Holidays

- 7 Long-Term Investment Strategies For Tax Delinquent Properties

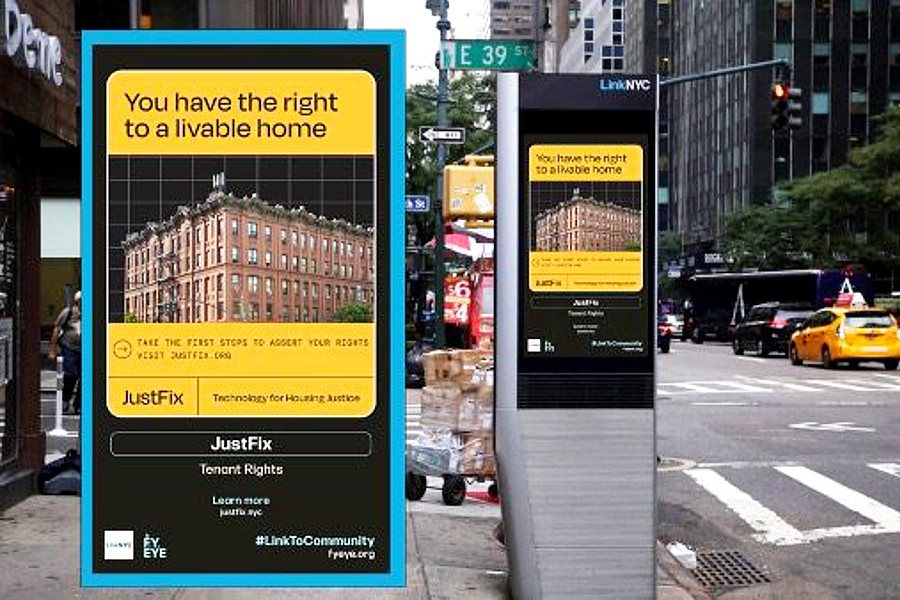

- How To Use Digital Signage For Business Marketing

- NYC’s Urban Agriculture Office Sows Seeds Of Change With ‘School Food Eats’

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact