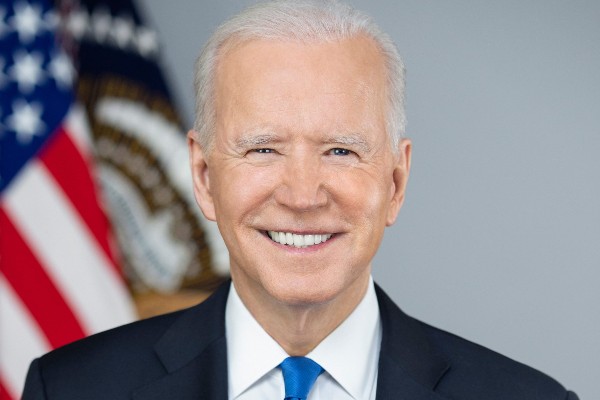

President Biden is extending the suspension on federal student loan payments and interest accrual through August 31, 2022. Originally, student loan repayments had been paused until May 1, 2022.

President Biden is extending the suspension on federal student loan payments and interest accrual through August 31, 2022. Originally, student loan repayments had been paused until May 1, 2022.

Biden’s reason is simple – the country is still trying to recover from the COVID-19 pandemic, and not everyone has had the opportunity to completely regroup.

“More than 217 million Americans are now fully vaccinated, and 2 out of 3 eligible adults are boosted. We have the tools we need to move forward safely and return to more normal routines,” Biden said in a statement.

“However, as I recognized in recently extending the COVID-19 national emergency, we are still recovering from the pandemic and the unprecedented economic disruption it caused. If loan payments were to resume on schedule in May, analysis of recent data from the Federal Reserve suggests that millions of student loan borrowers would face significant economic hardship, and delinquencies and defaults could threaten Americans’ financial stability.”

Just last month, economists said the end of the student loan moratorium would result in a rise in loan delinquencies

More time before payments resume

Biden stated that the extension of the moratorium will allow borrowers to get their financial life back on track while supporting the Department of Education’s efforts to continue improving student loan programs.

As part of this transition, the Department of Education stated that it will offer additional flexibility and support for all borrowers.

Officials said the chief benefit for borrowers will be extra time to plan for the resumption of payments. They hope that extra time will help reduce the risk of delinquencies and defaults after the restart.

Between now and August 31, 2022, the Department will attempt to refine the program so borrowers can smoothly transition back into a repayment plan.

“This includes allowing all borrowers with paused loans to receive a ‘fresh start’ on repayment by eliminating the impact of delinquency and default and allowing them to reenter repayment in good standing,” the Department noted.

Using extra time to focus on other goals

Department of Education officials said they will also be using this extra time granted by the extension to work on several other goals.

Some of those include:

- Helping consumers who were defrauded by their institutions and those eligible for relief through the Public Service Loan Forgiveness program.

- Establishing new partnerships to guarantee that borrowers who are working public service jobs are automatically credited with progress toward forgiveness.

- Cutting out extra hoops that borrowers have to jump through to get assistance.

More information about the payment pause and support for borrowers can be found at StudentAid.gov.

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact