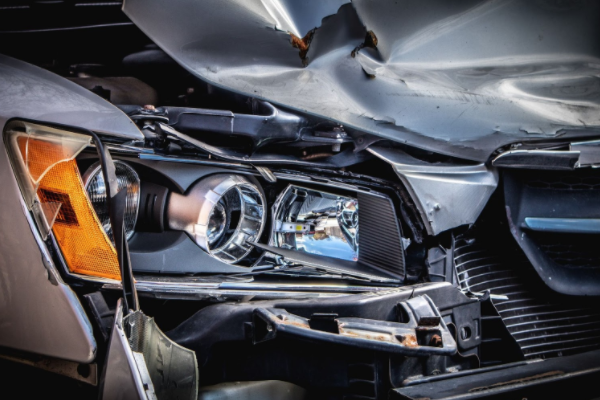

No matter how safe a driver you are, you can be involved in a car accident. When that happens, the next steps you want to take is to definitely call the police, the medic, and your lawyers.

No matter how safe a driver you are, you can be involved in a car accident. When that happens, the next steps you want to take is to definitely call the police, the medic, and your lawyers.

All of those professionals are very important when it’s time for you to file a claim.

Filing for an insurance claim means you’re making a request formally to your insurance company to get the money that’d help you pay for repairs and similar expenses that came about by a car accident. It has to be of course covered by insurance.

When you decide to file for car insurance, you need to know all the necessary information you’d have to provide for it to be successful and understand how it works. Knowing what to expect would help smoothen the process and ensure you have enough money to repair your vehicle quickly.

Find out if there’s a time frame for your insurance claim, and bear in mind that every insurance company has different ways by which they process claims. Take a look at some of what to expect below.

1. You’d Be Required to Provide Necessary Information About The Accident

Before you can be eligible to file a claim with the insurer, most insurance companies would require that you provide the right information and proper documentation as it relates to the accident. A good part of the required information you want to collate includes, but sometimes is not limited to:

- Names, addresses, insurance, and vehicle information of all the parties involved in the accident

- Time of the incident, location, and weather conditions

- Pictures of the damage

- Accident report

- Names and badge numbers of police officers or other professionals present.

These are some of the facts the company would like to see. It would be in your best interest to, if possible, video record everything.

2. Making Inquiries About What Your Insurance Covers

Filing for a claim means you understand what the process is all about and what your insurance covers. Such questions can be about

Duration Before a Claim Is Submitted

Find out from your insurer what time limits are in place for submitting claims. Why is this important? It’s because if you fail to submit the claim within the time frame, you may likely not be That’s because if you’re filing a claim after an accident and don’t submit it and the necessary documents within your insurer’s time limit, you may not be entitled to receive money from to help with your bills, vehicle, or medicals. Also, know that the time frame for each claim is dependent on the type of claim being filed.

Deductibles

Did you recall when you got your car insurance? Now, if you probably don’t remember whether you selected deductibles to cover only certain accidents like collision or comprehensive coverage, ensure you find out how much your deductible is. It’s the money you’re required to pay before the insurance funds come.

3. Be Ready To Team Up With The Insurance Adjuster

After the accident and when you’ve filed a claim, it is normal for your insurance company to send an insurance adjuster to examine your ride. The adjusters, who can practically be called detectives, see what got damaged in the incident and investigate the losses. This way, the insurance representative can easily determine who truly caused the accident. The adjuster also provides an initial estimate of the cost of repairs in terms of both parts and labor.

Not all insurance companies follow such procedures, some may require that you get the estimate for repair costs yourself from a repair shop. It is the mechanic, however, that sends reports to the insurance company. As you can imagine, it is that estimate they’d consider when they decide to pay your claim.

Keep in mind that insurance companies don’t want to spend much money, if they even spend any at all, so you shouldn’t joke with those documentations at all. Ensure they’re all correct before you file a claim.

4. Get The Vehicle In Shape

Of course, the reason why you want to file a claim is you can get compensated, having enough to repair your ride or take care of your health. So, after the money has been given, that should be what you do next. In cases where your car requires new parts, ask the company if your plan covers the purchase of new parts. If not, that one may be on you.

5. Expect Your Rights To Be Respected

This is a very important point to remember, just because you want a claim doesn’t mean you should be subjected to any violation of your human rights. It is within your rights if you’ve got insurance to know in a timely manner and with a clear explanation of the extent of their coverage decision. You are entitled to know how the insurance firm would get to pay your claim. Also, responding to your questions on time and offering timely payments are within your rights.

This is a very important point to remember, just because you want a claim doesn’t mean you should be subjected to any violation of your human rights. It is within your rights if you’ve got insurance to know in a timely manner and with a clear explanation of the extent of their coverage decision. You are entitled to know how the insurance firm would get to pay your claim. Also, responding to your questions on time and offering timely payments are within your rights.

6. Expect a Rental Car

When the accident isn’t your fault, by that we mean it was caused by the other driver, his or her insurer is to offer you a certain type of compensation to cover a rental car. It can be either on a basis of reimbursement or a direct bill set up that is the insurer pays the money directly to the rental agency.

On the other hand, if you’re at fault, you might have to find out from your own insurance company if there’s an available policy (known as transportation expense coverage) to cover the rental car. Your agent can also help with that too. As you can well imagine, getting the insurance to pay for a rental car or another means of transportation while your car is undergoing repairs would help you get back on your feet.

All these might be overwhelming for you but at the same time, it’s important for you to be prepared. Even though you’re a smart person, reduce the stress and let a lawyer take charge for you.

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact