Condo insurance is different from typical insurance. The two main types are wall-in policies and all-in policies, which significantly differ from each other.

Getting insurance in recent days has become almost a trend, and almost everyone gets insurance for their belongings.

This is also true for condos as most people want to have insurance that will keep their condo safe.

By the end of this article, you will know the essential factors and differences in insurance cost and the other relevant information you need.

About Condo Insurance

Condo insurance differs from your standard insurance policies. For example, you only need your house insurance policy for your house insurance and see how much that costs.

But for condos, not only do you need your own condo insurance policies, but you also require your condo association’s policy.

This associate’s policy is generally known as master policy, and there are two types of master policies that are the most common.

They are the all-in policies that the name suggests cover everything both in and outside your condo, and wall-in policy, which only includes the exterior of your condo.

The costs of these policies can vary depending on location. Beach Condos like the ones in Myrtle Beach have low-cost insurance policies that everyone can enjoy. Jerry Pinkas real estate can show you all the best policies and more about Myrtle Beach.

Cost Of Insurance In Different States

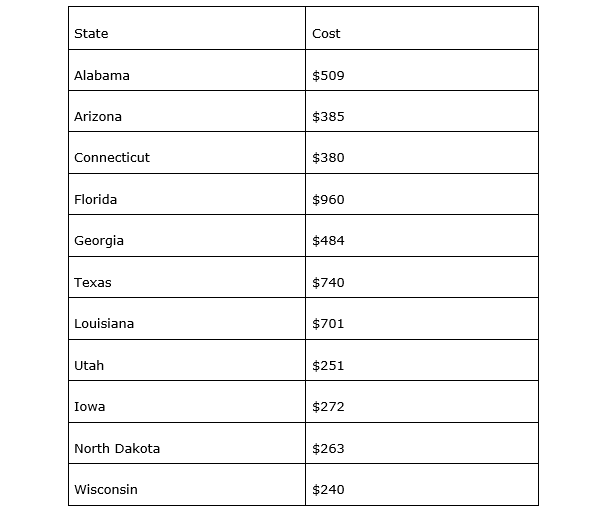

The cost of insurance can vary from one place to another. The cost of insurance in New York will not be the same as in Washington. Here is a list of a few states and the cost of insurance in those states.

This chart was made by the National Association Of Insurance Commissioners in 2015. According to their list, the cheapest cost of insurance was in Wisconsin, and the most expensive cost of insurance was in Florida.

This chart was made by the National Association Of Insurance Commissioners in 2015. According to their list, the cheapest cost of insurance was in Wisconsin, and the most expensive cost of insurance was in Florida.

The areas with high costs like Florida and Louisiana are very disaster-prone, and places like Utah and Wisconsin rarely have any disaster, so the property rarely gets damaged.

Factors That Determine The Cost Of insurance

Apart from the standard cost in different states, various factors will determine whether insurance costs will increase.

Some of these factors can be controlled by you, while others are circumstantial, and you will have no control over them.

Factors That Can Be Controlled

1. Total Coverage

When buying your insurance policy, you can decide how much property of your condo you want to be covered, how much liability you are willing to cover, and how much additional coverage you want. You can either decrease or increase your cost if you wish.

2. Discounts

Many insurance companies offer various discounts on their insurance policy on premium monthly or annual policies. It is up to you to decide whether you want to take the larger discount and take the yearly insurance, or the smaller but more flexible monthly discount.

3. Reducible Amount

Whn there is an event of a claim, an amount of money that you can pay out of your pocket is called a reducible amount. From time to time, this can reduce the cost of your overall insurance as you are paying that money in that event out of your pocket.

Factors That Cannot Be Controlled

1. Location

Insurance cost varies from one state to another based on the lifestyle, disaster frequency, and cost of living.

States with higher insurance costs, like Florida and Texas, have a higher population and a more frequent disaster rate.

The condos might get damaged, and as they are expensive, the cost of insurance is higher. The exact opposite is for states with lower insurance costs as those states hardly face any disaster.

Do your research before going into a negotiation because the insurance company costs can vary significantly just because it is different.

2. Condos lifespan

If you bought a relatively older condo, chances are it has different problems like a damaged electricity line or a damaged pipeline. If this is the case, they will frequently break down and take a lot of money out of your insurance policy. The problem is not that common with newer condos.

The best thing you can do is renew the plumbing and electricity line or any damaged asset before getting an insurance policy.

3. Master Policy

The homeowner association or HOA might have an all-in policy, including everything in and on your condo to be under the insurance policy.

If it was a wall in policy, the cost could have been drastically reduced, but as it is not up for you to decide, you cannot determine its cost.

Essential Coverage You Should Have

1. Personal Property

Whenever you are planning to buy an insurance policy, make sure it includes your personal property. This should cover appliances, furniture, clothing, and electronic items if they get damaged. You can also add an umbrella policy for a particular item coverage.

2. Living Coverage

It entirely depends on what master policy you have. If it is all in, then you do not need to worry as all of it is in the insurance policy. If it is wall-in, you need to add the interiors like walls, floor, cabinets, and other interior appliances in your insurance.

3. Loss Of Use CoverageThis takes up about 20% of your living coverage and includes relocation, food, and living expenses up to that certain 20%.

4. Additional Coverage

You need to think about this if you want to make some specific improvements to your condo.

This may cover for a better bathroom system, better kitchen system, or better cabinets. This additional coverage will handle all the expenses related to these improvements and upgrades.

Final Thoughts

To make life easier and much less worrying, it is wise to have an insurance policy to know that this insurance plan will cover things in times of danger or uncertainty. Since condos are luxury assets, it is wise to have an insurance policy for a condo so that when it gets damaged or needs some improvements, the insurance policy will be there to take care of it.

Become a Harlem Insider!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact